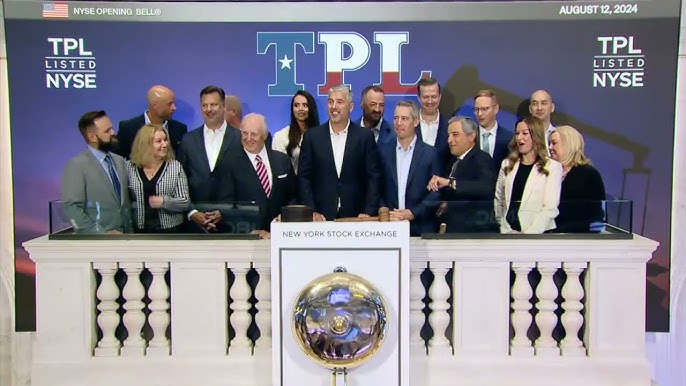

Texas Pacific Land Corporation (NYSE:TPL) Announces Stock Split and Strategic Partnership

Font: Financial Modeling Prep • Dec 17, 2025

- Texas Pacific Land Corporation (NYSE:TPL) is set to execute a stock split, offering 3 shares for every 1 share owned, aimed at increasing stock liquidity.

- The company announced a strategic partnership with Bolt to develop data center campuses in West Texas, leveraging the growing demand for data processing and storage.

- TPL's stock surged by 8% following the partnership announcement, outperforming the broader market downturn.

Texas Pacific Land Corporation (NYSE:TPL) is a prominent player in the land management and resource sector, primarily operating in West Texas. The company manages vast land holdings and is involved in oil and gas royalties, water services, and land sales. TPL's strategic initiatives often attract investor attention, especially when they align with emerging industry trends.

On December 23, 2025, TPL will execute a stock split, offering shareholders 3 shares for every 1 share they currently own. This move is typically aimed at increasing the stock's liquidity and making it more accessible to a broader range of investors. Stock splits do not change the company's market capitalization but can influence investor perception and trading activity.

Recently, TPL's shares surged following the announcement of a strategic partnership with Bolt to develop data center campuses in West Texas. This collaboration is set to capitalize on the growing demand for data processing and storage, particularly in the artificial intelligence infrastructure sector. The market responded positively, with TPL's stock climbing by 8% amidst a broader market downturn, as highlighted by Invezz.

Currently, TPL's stock is priced at $876.41, marking a $55.72 or 6.79% increase today. The stock has seen fluctuations, trading between $830.34 and $892.00. Over the past year, TPL's stock has ranged from a high of $1,462.78 to a low of $807.70. The company's market capitalization is approximately $20.14 billion, with a trading volume of 130,525 shares on the NYSE today.

Market Overview

|

SOXS

Direxion Daily Semiconductor Bear 3X Shares

|

$1.70

-2.86%

|

|

MGRX

Mangoceuticals, Inc.

|

$0.53

48.83%

|

|

RXT

Rackspace Technology, Inc.

|

$1.68

37.14%

|

|

ZSL

ProShares UltraShort Silver

|

$2.02

-14.88%

|

|

BHAT

Fujian Blue Hat Interactive Entertainment Technology Ltd.

|

$0.11

-74.26%

|

|

NVDA

NVIDIA Corporation

|

$189.82

1.02%

|

|

OPEN

Opendoor Technologies Inc.

|

$5.00

7.53%

|

|

TZA

Direxion Daily Small Cap Bear 3X Shares

|

$6.02

0.25%

|

|

TQQQ

ProShares UltraPro QQQ

|

$50.06

2.52%

|

|

ONDS

Ondas Holdings Inc.

|

$10.03

-11.94%

|