Intel Corporation (NASDAQ:INTC) Stock Update and Market Performance

Font: Financial Modeling Prep • Jan 23, 2026

- Roth Capital adjusts Intel's rating to "Neutral" and raises the price target from $40 to $50.

- Intel's strong Q4 earnings surpass expectations, yet the stock experiences a sell-off amidst broader market gains.

- The company's market capitalization stands at approximately $259.1 billion, with a significant trading volume of 154.05 million shares.

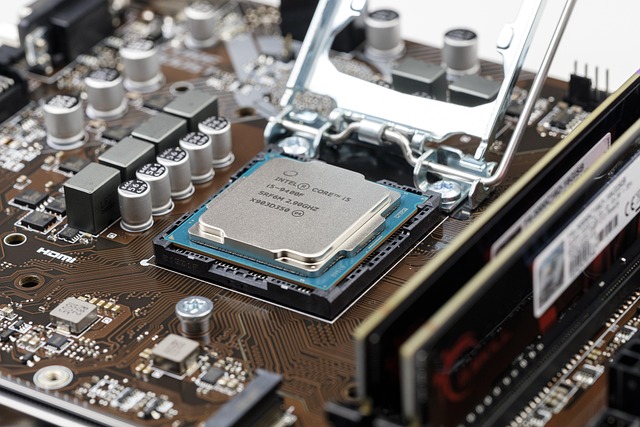

Intel Corporation (NASDAQ:INTC) is a leading technology company known for its semiconductor products, competing with tech giants like AMD and NVIDIA. On January 22, 2026, Roth Capital adjusted its rating for Intel to a "Neutral" grade, maintaining a "hold" action. At that time, Intel's stock price was $54.32, and Roth Capital raised its price target from $40 to $50, as highlighted by TheFly.

Despite Intel's strong fourth-quarter earnings, which exceeded expectations on both revenue and profit, the stock experienced a sell-off. This decline occurred even as broader market indices like the Dow, S&P 500, and Nasdaq saw gains, with the Nasdaq increasing by 0.91%. The market's positive movement was supported by favorable economic data, including a revision in Q3 GDP and positive jobless claims.

Intel's stock, priced at $54.32, saw a slight increase of 0.07, or 0.13%, on the day. The trading range for the day was between $53.08 and $54.59, with the latter marking its highest price over the past year. The lowest price for Intel's stock in the past year was $17.67, indicating significant volatility.

Intel's market capitalization is approximately $259.1 billion, reflecting its substantial presence in the tech industry. The trading volume for the day was 154.05 million shares, showing active investor interest. Despite the sell-off, Intel remains a key player in the semiconductor market, with its stock performance closely watched by investors.

Market Overview

|

SOXS

Direxion Daily Semiconductor Bear 3X Shares

|

$1.76

-2.76%

|

|

IVDA

Iveda Solutions, Inc.

|

$0.34

16.21%

|

|

QNCX

Quince Therapeutics, Inc.

|

$0.20

-11.31%

|

|

ZSL

ProShares UltraShort Silver

|

$2.51

-5.99%

|

|

NVDA

NVIDIA Corporation

|

$182.81

-2.21%

|

|

RIME

Algorhythm Holdings, Inc.

|

$3.48

222.22%

|

|

RIVN

Rivian Automotive, Inc.

|

$17.73

26.64%

|

|

TQQQ

ProShares UltraPro QQQ

|

$48.47

0.44%

|

|

BURU

Nuburu, Inc.

|

$0.10

-20.33%

|

|

TZA

Direxion Daily Small Cap Bear 3X Shares

|

$6.12

-3.77%

|