Intel Corporation (NASDAQ:INTC) Stock Update and Investment Moves

Font: Financial Modeling Prep • Feb 12, 2026

- D.A. Davidson sets a price target of $45 for Intel Corporation (NASDAQ:INTC), slightly below its current trading price.

- Caisse Des Depots ET Consignations reduces its Intel holdings by 15.9%, signaling potential concerns about the company's future performance.

- Despite some sell-offs, other investors like Savvy Advisors Inc. and Allegheny Financial Group are increasing their stakes, showing confidence in Intel's potential.

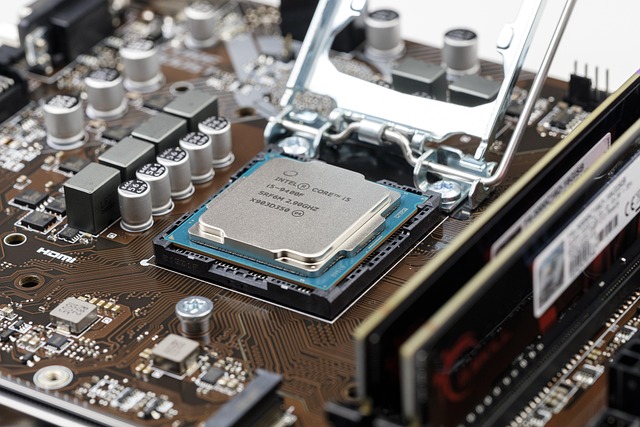

Intel Corporation (NASDAQ:INTC) is a leading technology company known for its semiconductor products. It competes with other tech giants like AMD and NVIDIA. On February 12, 2026, D.A. Davidson set a price target of $45 for Intel. At that time, Intel's stock was priced at $46.48, showing a -3.18% difference from the target.

Caisse Des Depots ET Consignations recently reduced its Intel holdings by 15.9%, selling 41,611 shares. This sale left them with 220,030 shares valued at $7.38 million. This move might reflect a cautious stance towards Intel's future performance, given the price target set by D.A. Davidson.

In contrast, other investors are increasing their stakes in Intel. Savvy Advisors Inc. boosted its holdings by 25.3%, adding 16,330 shares, totaling 80,857 shares valued at $2.71 million. Allegheny Financial Group also acquired a new stake worth $249,000, indicating confidence in Intel's potential.

Intel's current stock price is $46.48, a decrease of 3.75% or $1.81. The stock has traded between $46.20 and $48.95 today. Over the past year, it reached a high of $54.60 and a low of $17.67. With a market cap of $232.17 billion and a trading volume of 87.85 million shares, Intel remains a significant player in the tech industry.

Market Overview

|

SOXS

Direxion Daily Semiconductor Bear 3X Shares

|

$1.76

-2.76%

|

|

IVDA

Iveda Solutions, Inc.

|

$0.34

16.21%

|

|

QNCX

Quince Therapeutics, Inc.

|

$0.20

-11.31%

|

|

ZSL

ProShares UltraShort Silver

|

$2.51

-5.99%

|

|

NVDA

NVIDIA Corporation

|

$182.81

-2.21%

|

|

RIME

Algorhythm Holdings, Inc.

|

$3.48

222.22%

|

|

RIVN

Rivian Automotive, Inc.

|

$17.73

26.64%

|

|

TQQQ

ProShares UltraPro QQQ

|

$48.47

0.44%

|

|

BURU

Nuburu, Inc.

|

$0.10

-20.33%

|

|

TZA

Direxion Daily Small Cap Bear 3X Shares

|

$6.12

-3.77%

|