Intel Corporation's Stock Performance and Market Position

Font: Financial Modeling Prep • Feb 02, 2026

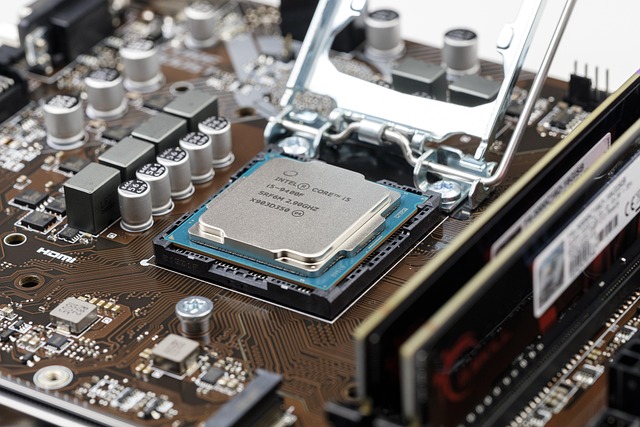

Intel Corporation, trading under the symbol INTC on the NASDAQ, is a leading player in the semiconductor industry. The company designs and manufactures essential components for computers and other electronic devices. Intel faces competition from other tech giants like Nvidia and AMD, which also produce advanced semiconductor products.

On February 2, 2026, UBS set a price target of $51 for Intel, which was trading at $47.58 at the time. This target suggests a potential increase of 7.19% from the current price. As of now, Intel's stock is priced at $47.93, showing a 3.14% increase today, equivalent to a $1.46 rise.

Despite the sluggish start in early pre-market trading for US tech stocks, including Intel, Nvidia, and AMD, Intel's stock has shown resilience. The stock has fluctuated between $45.51 and $48.24 during the trading day. This volatility reflects traders adjusting to shifts in risk appetite.

Intel's market capitalization is approximately $239.4 billion, with a trading volume of 22.1 million shares. Over the past year, the stock has seen a high of $54.60 and a low of $17.67. These figures highlight the stock's potential for growth and the interest it garners from investors.

Market Overview

|

SOXS

Direxion Daily Semiconductor Bear 3X Shares

|

$1.76

-2.76%

|

|

IVDA

Iveda Solutions, Inc.

|

$0.34

16.21%

|

|

QNCX

Quince Therapeutics, Inc.

|

$0.20

-11.31%

|

|

ZSL

ProShares UltraShort Silver

|

$2.51

-5.99%

|

|

NVDA

NVIDIA Corporation

|

$182.81

-2.21%

|

|

RIME

Algorhythm Holdings, Inc.

|

$3.48

222.22%

|

|

RIVN

Rivian Automotive, Inc.

|

$17.73

26.64%

|

|

TQQQ

ProShares UltraPro QQQ

|

$48.47

0.44%

|

|

BURU

Nuburu, Inc.

|

$0.10

-20.33%

|

|

TZA

Direxion Daily Small Cap Bear 3X Shares

|

$6.12

-3.77%

|